Yes, this feature is available for participating life insurance.

However, the

financial needs analysis (FNA) is essential in identifying required insurance coverage. You can use it to see the gap between your client's current situation and their actual insurance needs, and how to fill it. You can then recommend the right coverage for all their insurance needs based on their financial situation.

To use this feature:

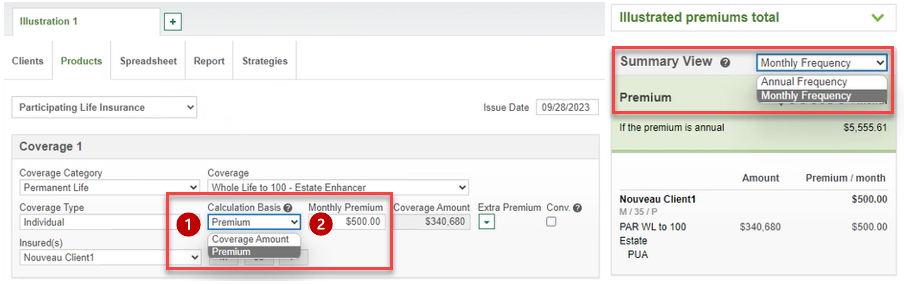

- In the

Calculation Basis dropdown menu, select

Premium.

- Enter the premium amount in the

Monthly Premium or

Annual Premium field, according to the frequency selected in

Summary View.

Details

The premium entered does not include the cost of the additional coverages selected. As needed to stick to the client's budget, you have to subtract the cost of any additional coverage selected.

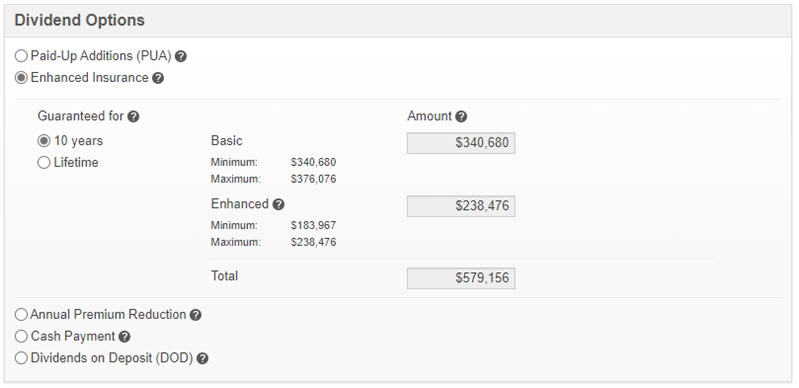

If the

Enhanced Insurance dividend option is selected, the tool automatically calculates the enhanced amount. That means minimum and maximum amounts are determined for both

Basic and

Enhanced insurance. You cannot modify the

Basic amount or the

Total. However, you can choose the

Guaranteed for amount (10 years or

Lifetime, except for the 5 Pay PAR product, for which only the

Lifetime option is available).