The client uses funds otherwise invested in their taxable investment accounts and other available liquid assets to purchase a cash value life insurance policy on the life of their child. The policy is part of the legacy that they plan to leave for their child, so the premium payments redirect a portion of this planned legacy into a tax-advantaged exempt life insurance policy. This provides a tax-efficient way for them to make an intergenerational wealth transfer to their child. This reduces the tax burden on their taxable investments during their lifetime. When they are ready, they can transfer ownership of the policy to their child on a tax-deferred basis using an Intergenerational Policy Rollover under the tax rules.

Definition

Child: For the purposes of taxation and of this concept, the definition of “child” includes:

- A child of the policyowner

- A grandchild of the policyowner

- A person who, before reaching 19 years of age, relied entirely on the policyowner for financial support and was under the policyowner’s custody and control, whether in law or in fact

- A person of whom the policyowner is a legal parent

- A child of the policyowner’s spouse or common-law partner

- A person who was a child of the policyowner immediately before the death of the person’s spouse or common-law partner

See subsections 148(9) “child”, 70(10) and 252(1) of the

Income Tax Act for more details.

Intergenerational policy rollover

When the policyowner of a life insurance policy transfers the policy during lifetime for no consideration or on death via a contingent owner appointment to a “child” as defined for tax purposes and the “child” is the person whose life is insured under the policy, the transfer is deemed to occur at the policy’s adjusted cost basis. This results in a tax-deferred rollover to the child.

However, the intergenerational policy rollover will typically not apply if an interest in a life insurance policy is transferred to a child under provisions in the policyowner’s will or to a trust for the benefit of a child, if the child is not the only life insured on the policy at the time of transfer or if a consideration is paid for the transfer.

See subsection 148(8) of the

Income Tax Act for more details.

Benefits

- Provides a living gift

- Maintains control over the policy

- Child is insured for life*

- Meets the child’s changing lifetime needs

- Simplifies intergenerational wealth planning

- Reduces tax burden during lifetime and upon death**

*As long as required premiums are paid or it’s a paid-up policy.

**Cash values will grow inside the permanent life insurance policy on a tax-deferred basis as long as they remain inside the policy.

Eligible products

Participating whole life insurance

- 5 Pay PAR

- Accelerated Growth (10 Pay, 20 Pay or to 100)

- Estate Enhancer (10 Pay, 20 Pay or to 100)

Grandparents

The Generational Legacy Plan (GLP) is suitable for clients who:

- are retired or approaching retirement, with taxable investments generating income not required to maintain their lifestyle

- want to leave an inheritance for their grandchild with a permanent life insurance policy*

- want flexibility to make adjustments if things change unexpectedly

- want to minimize taxes during lifetime while creating a tax-deferred lifelong legacy**

- have grandchild who is in good health and insurable

Parents

The Generational Legacy Plan (GLP) is suitable for clients who:

- are enjoying life, with a balance of work and leisure activities

- have low to moderate debt and a growing taxable investment portfolio

- want to leave an inheritance for their child that provides the child with a permanent life insurance policy*

- want flexibility to make adjustments if things change unexpectedly

- want to minimize taxes during lifetime while creating a tax-deferred lifelong legacy**

- have a child who is in good health and insurable

*As long as required premiums are paid or it’s a paid-up policy.

**Cash values will grow inside the permanent life insurance policy on a tax-deferred basis as long as they remain inside the policy.

The Generational Legacy Plan (GLP) is available in the

illustration tool. Go to the

Strategies tab and open the

Concepts – Affluent menu.

Procedure

- Click on the

Strategies tab

- Open the

Concepts section

- In the

Affluent section, select

Generational Legacy Plan

- Click the

Export button to download the illustration data to an Excel spreadsheet

Open the downloaded file through your browser or in your

Downloads folder

You'll have 60 minutes to open the file and access the data in the illustration. After that, you'll have to download the spreadsheet again. - Enable content and macros when opening the spreadsheet

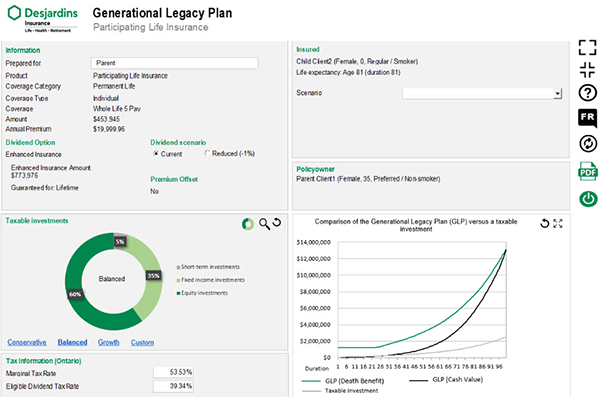

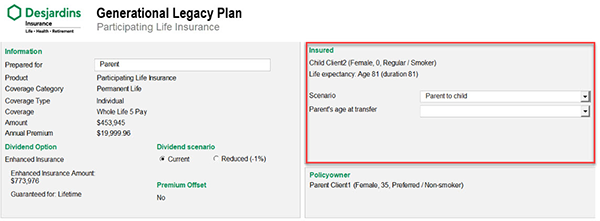

- This screen will appear for the selected product

- Make sure the information about the proposed insured and the insurance coverage is correct.

If it isn't, exit the page and restart the illustration. - In the

Insured section, select the scenario you want to analyze:

- Grandparent to grandchild

- Parent to child

- Grandparent to adult child to grandchild

After a scenario is selected, select a duration for

Grandparent’s age at transfer or

Parent’s age at transfer depending on the scenario.

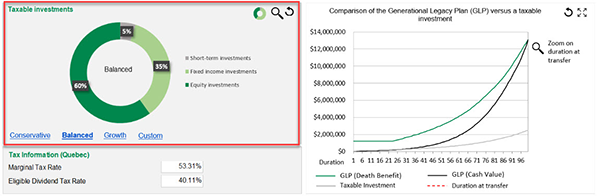

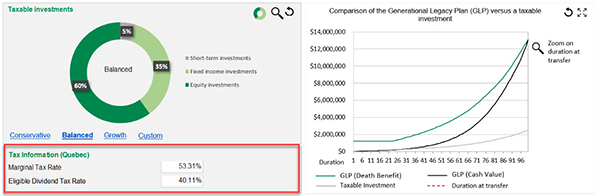

- Create a hypothetical portfolio in the

Taxable Investments section, allocating to interest, dividend and capital gain income

The allocation must always add up to 100%.

For each type of investment, choose a rate of return that's realistic and takes the current situation into account. This investment portfolio will be compared to the values of insurance policy.

The amounts invested in taxable investment account and Generational Legacy Plan are the same. You can view the investment composition as a chart or a table, depending on your preference.

- In the

Tax Information section, tax information will be pre-populated based upon the highest marginal tax rate in the client’s province of residence; this can be modified as needed.

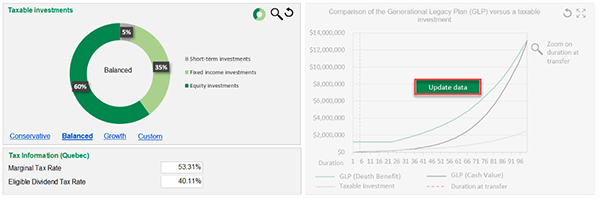

- Once you've entered all the relevant information, click on

Update data to update the charts based on the data you entered.

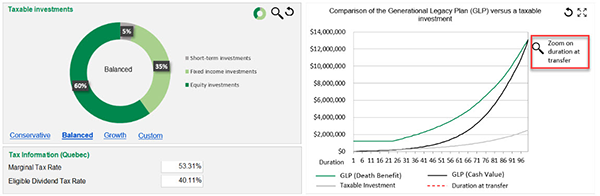

- The chart also has an option to

Zoom on duration at transfer to show the impact on taxable investments upon transfer and comparison with the Generational Legacy Plan.

- Confirm the fields and click on the

PDF icon

The Generational Legacy Plan concept report will appear in PDF format. - The report is automatically saved in the

/Downloads/Desjardins.

You can also save it manually. - Go back to the Generational Legacy Plan input screen and click

Exit

You can only use the saved PDF copy of the report.

To present the strategy again, you'll need to create a new illustration and download it from the

Strategies tab.

Examples of concept reports